According to the latest data released by the National Statistical Office (NSO) on November 30, the Indian economy experienced a healthy growth rate of 8.4 percent during the second quarter of the financial year 2021-22. The July-September period witnessed a boost that was aided by increased vaccination and an uptick in agriculture, public administration and the defence services sector.

This quarter is the fourth consecutive positive growth after the negative contraction witnessed in 2020. The previous quarter experienced a 20.1 percent expansion and the current fiscal growth data presented by the NSO is comparatively slower. However, the gain in momentum has provided a ray of hope for normalcy in the aftermath of the second wave of the COVID-19 pandemic. These results reflect a healthy recovery, particularly in private consumption expenditure. While private consumption at Rs 19.48 lakh crores was 8.64 percent higher than Rs 17.93 lakh crores in Q2 last year, the increase was slow compared to the pre-pandemic level of Rs 20.19 lakh crores during Q2 2019-20.

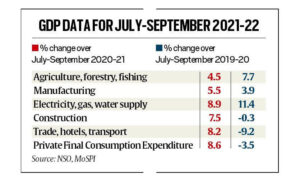

The Q2 data showed that the agriculture sector delivered back-to-back 4.5 percent growth due to a good monsoon season. The hotel, trade and transport sectors witnessed improved growth of 8.2 percent in July-September as against a sharp 16.1 percent contraction last year, a win for the service sector due to increased private consumption. Electricity, gas, water supply, and other utility services grew 8.9 percent as against 2.3 percent last year. The 1.5 percent rise in Gross Fixed Capital Formation that acts as an indicator of investments compared to the pre-pandemic year 2019-20 was also a silver lining. Even the manufacturing sector witnessed a 5.5 percent increase as against the 1.5 percent contraction in the same period last year, reflecting both a recovery in domestic demand and buoyant exports.

The RBI had earlier projected a growth rate of 7.9 percent in Q2 this year. The GDP in absolute terms at Rs 35.73 lakh crores was 0.33 percent higher than the pre-pandemic levels of Q2 in 2019-20, indicating a recovery from loss witnessed due to the Delta variant surge earlier this year. However, construction and all industry segments did not witness a higher output level than 2019-20 compared to other sectors.

“The GDP growth for Q2 at 8.4 percent confirms that the economy gained traction in the second quarter. On the supply side, agriculture growth provided support, along with a pick-up in service sector growth at 10.2 percent as contact-intensive services improved along with financial and real estate sectors. On the demand side, investment growth provided support. The momentum in GDP growth has moved to the positive in the second quarter compared to a contraction in Q1,” said Sakshi Gupta, senior economist at HDFC Bank.

Valuable assets with store value such as art, precious metals and jewellery also saw a surge and contributed to the higher growth rate. It stood at Rs 1.19 lakh crores in July-September compared to Rs 42,253 crores in Q2 last year and Rs 44,242 crores in Q2 during 2019-20.

Read more: India’s Economic Resilience And The Need To Focus On An Inclusive Future

With vaccination rates picking up and cases dramatically falling to 10,000, confidence in the market has come back with them reopening for business. However, the emergence of the Omicron variant could pose concern as the economy is still in recovery from the Delta variant. Economists have expressed concern over long-lasting recovery in the third quarter once the base effect starts waning, along with inflation concerns and uncertainty around the extent to which Omicron could hurt the global recovery and pose a challenge for monetary policy going ahead. “While the Q2 FY2022 absolute level of real GDP reverted mildly above the pre-COVID level of Q2 FY2020, the disaggregated data for Q2 FY2022 is far from convincing, with considerable lags in private and government consumption expenditure being absorbed by a sharp rise in valuables relative to the pre-COVID level of Q2 FY2020. The 1.5 percent rise in gross fixed capital formation in Q2 FY2022 relative to Q2 FY2020 appears to be the lone silver lining,” said Aditi Nayar, chief economist at ICRA. However, Chief Economic Adviser K.V. Subramanian said that India is expected to experience double-digit growth in 2021-22 due to rising demand and a robust banking sector. He said that the seminal second-generation reforms would help the country grow over 7 percent this decade.