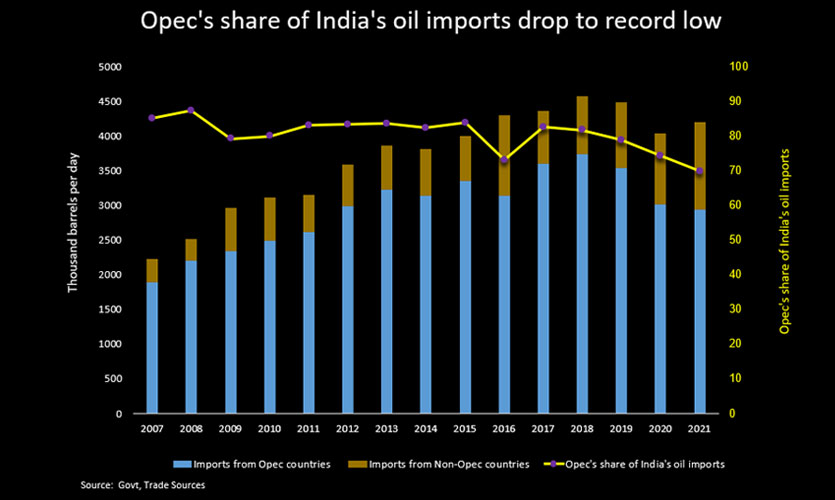

In 2021, the Organization of Petroleum Exporting Countries (OPEC) share of Indian oil imports fell to the lowest in 15 years. This was despite the data obtained from industry sources that showed annual crude purchases witnessing almost a 4 percent higher rebound in more than a decade.

As per Reuters’ analysis of data from 2007 to 2021, members from the Middle East and Africa saw their share in the world’s third biggest oil importer shrinking to 70 percent in 2021, from a peak of 87 percent in 2008. According to the data, India’s crude imports rebounded by 3.9 percent to 4.2 million barrels per day (bpd) in 2021, however, they still remained lower than pre-pandemic levels in 2019.

A positive rise in imports is expected this year as fuel demand is recovering while refiners’ margins are expected to stay strong. Governments have been trying to manage the surge in COVID-19 cases without the need for lockdowns, compared to last year when refiners had to cut crude processing for a few months due to the lockdowns that hit gas, oil and jet fuel consumption. Imports had surged to an 11-month high of about 4.7 million bpd in December 2021, amounting to about 5 percent more than in November, but 7.8 percent lower than the year before.

Read more: China Releases Diesel And Gasoline Reserves To Meet Demand, Oil Prices Fall

Chairman of the state-run Hindustan Petroleum Corp (HPCL), MK Surana said, “With fears of Omicron spread receding and refineries expected to operate at full capacity because of improved cracks and fuel demand, Indian oil imports could rise by about 5 percent.” The data analysed has further revealed that OPEC’s share reduced as refiners increased imports from Canada and the United States, at the expense of Africa and the Middle East. It has become difficult for India to import crude from Venezuela and Iran as a result of the US’ sanctions. As a result, Indian buyers now have to buy supplies from the United States, Canada, Guyana and some small producers in Africa.

India’s imports consisted of 7.3 percent US and 2.7 percent Canadian oil, compared with 5.5 percent and 0.7 percent, respectively, a year earlier. The pressure from the US’ sanctions on Venezuela halted Indian imports and led to the share of Latin American oil to plunge to a 12-year low of 8.7 percent. Middle Eastern oil accounted for about 62 percent of India’s overall imports. Iraq continued to be India’s top supplier in 2021 since it overtook Saudi Arabia in 2017. Iraqi supplies to India are expected to increase in 2022 as HPCL plans to lift 45 percent more crude for its expanded refining capacity.